what is the property tax rate in dallas texas

According to the Tax Foundation that makes the overall state and local tax burden for. Learn about the role and services offered by the.

Buying Or Selling Irving Tx Real Estate The Timing Couldn T Be Bette Dallas Real Estate Real Estate Real Estate Marketing

Total Property Tax Rate.

. As you can see taxes can vary a great deal depending on where you are in the state. School Property Tax Rate. Did South Dakota v.

The general countywide rate is 0391. The median property tax on a 12970000 house is 282746 in Dallas County. Carrollton Carrollton-Farmers Branch isd 256.

Carrollton Dallas isd 256. Texas has no state property tax. Access to Market Value Tax Info Owners Mortgage Liens Even More Property Records.

If you need to find your propertys most recent tax assessment or the actual property tax due on your property contact the Dallas County Tax Appraisers office. The average effective property tax rate in Harris County is 203 significantly higher than the national average. However Texas has no income tax and no vehicle property tax.

The Dallas sales tax rate is. Dallas carrollton-farmers branch isd 274. Details on the submission process is included in the Electronic Appraisal Roll Submission Manual PDF.

The Texas sales tax rate is currently. The levies shown do not reflect actual tax collections. 1- As a general rule of thumb depending on where you buy in the Dallas Metroplex property tax rates fall between 197 percent and 343 percent of assessed home value.

Whether you are already a resident or just considering moving to Dallas to live or invest in real estate estimate local property tax rates and learn how real estate tax works. Wayfair Inc affect Texas. Thats up to local taxing units which use tax revenue to provide local services including schools streets and roads police and fire protection and many others.

Sales Tax State Local Sales Tax on Food. Records Building 500 Elm Street Suite 3300 Dallas TX 75202. Sales tax The state of Texas collects 625 on purchases and the City collects another 2 for a total of 825.

County Property Tax Rate. 104 rows TOTAL TAX RATE. The median property tax on a 12970000 house is 234757 in Texas.

Ad No Fee Unless We Save You Money. When compared to other states Texas property taxes are significantly higher. Dallas Dallas isd 274.

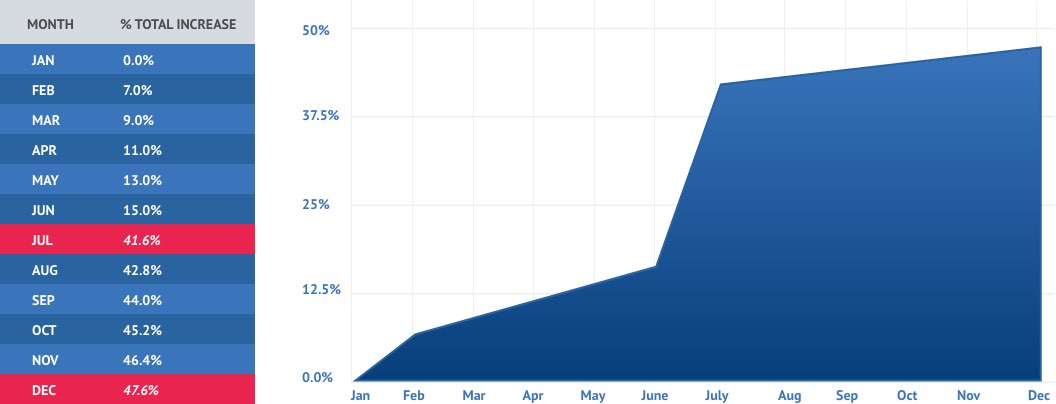

214 653-7811 Fax. Learn all about Dallas real estate tax. 2022 Tax Rates Estimated 2021 Tax Rates.

Below is a table to show you the break down of the municipal school and county taxes that create the property tax total for these communities. The highest rates however are those levied by school districts. Municipal Property Tax Rate.

The current total local sales tax rate in Dallas TX is 8250. Coppell Carrollton-Farmers Branch isd 253. Ad Get In-Depth Property Reports Info You May Not Find On Other Sites.

Media of Search and Search Data for Property Taxes Dallas. 2- Texas on a state-by-state basis has the fifth highest property tax rate in the United States. On top of that the state sales tax rate is 625.

While the national average tends to fall between 108 and 121 Texas average effective property tax rate is above 183. The minimum combined 2022 sales tax rate for Dallas Texas is. To see the change in property tax rates and values over time check out Property Tax History or Dallas Countys Truth in Taxation page below.

1 2020 tax rates and tax rate related information is reported to the comptroller on Form 50-886-a Tax Rate Submission Spreadsheet XLSX. Learn about Dallas metro property tax rates - Property tax rates for all major DFW metroplex citiestowns school districts and DFW metroplex counties. Addison Carrollton-Farmers Branch isd 252.

The median property tax also known as real estate tax in Dallas County is 282700 per year based on a median home value of 12970000 and a median effective property tax rate of 218 of property value. In Jefferson County Texas property taxes average around 1800 for homes with a median value of 101000 and a tax rate of 178 and in Williamson County Texas the property tax value is around 4600 when the tax rate is 203 for a home appraised at 227000. Select Dallas Property Tax Payment Option.

The County sales tax rate is. RE trans fee on median home over 13 yrs Auto sales taxes amortized over 6 years Annual Vehicle Property Taxes on 25K Car. The Comptrollers office does not collect property tax or set tax rates.

That average rate incorporates all types of taxes including school district taxes city taxes and special district levies. Coppell Coppell isd 269. Dallas Property Tax Protest Service.

Flower Mound - 208. Real property tax on median home. Dallas County Property Tax Search.

Here are the five DFW-area suburbs with the lowest total property tax rates in order from low to high. Select dallas county property tax related options. Addison Dallas isd 252.

This is the total of state county and city sales tax rates.

What Is The Property Tax Rate In Plano Texas Real Estate Luxury Real Estate Agent Real Estate Agent

Texas Senate Eyes Elimination Of Isd Maintenance Operations Property Tax Rate The Texan

Tarrant County Tx Property Tax Calculator Smartasset

Which Texas Mega City Has Adopted The Highest Property Tax Rate

What You Should Know About Dfw Suburb Property Taxes 2021 Nail Key

What Is The Property Tax Rate In Southlake Texas Property Tax Southlake Southlake Texas

What The Bleep Is Going On With Texas Property Taxes Texas Monthly

Why Are Texas Property Taxes So High Home Tax Solutions

Cypress Texas Property Taxes What You Need To Know Property Tax Tax Attorney Tax Lawyer

Property Tax Penalty Chart Texas Property Tax Penalties And Interest Chart Tax Ease

If Dallas Property Tax Rates Are Going Down Why Are My Payments Going Up Mansion Global

Taxes Celina Tx Life Connected

What The Bleep Is Going On With Texas Property Taxes Texas Monthly

Buying Or Selling Celina Tx Real Estate The Timing Couldn T Be Bette Property Tax Real Estate Dallas Real Estate

Property Tax Penalty Chart Texas Property Tax Penalties And Interest Chart Tax Ease

Texas Property Tax Rates Cantrell Mcculloch Inc Property Tax Advisors

Homeowners Wallets Still Hit By City And County Property Tax Growth Texas Scorecard